Russell Price, Chief Economist – Ameriprise Financial

Aug. 1, 2022

With home prices in many local markets reaching record levels in 2020 and 2021, homeowners and prospective homeowners alike are wondering what’s next for the housing market.

Ameriprise Financial Chief Economist Russell Price answers the top 5 real estate questions our clients are asking.

1. What has caused home prices to appreciate so much over the last two years?

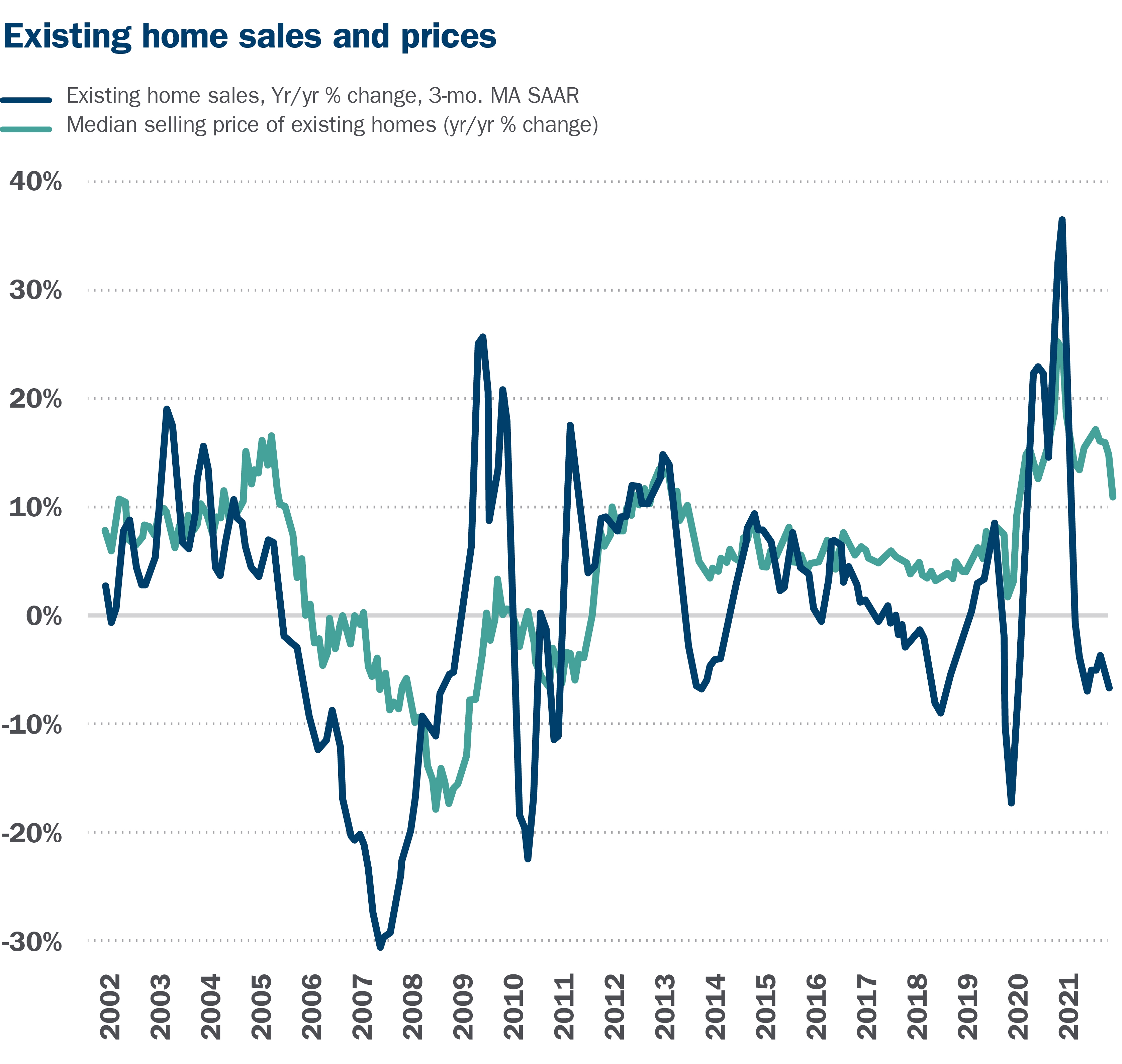

Strong demand and a lack of supply. National average home prices were 15% higher in 2021 after a 9% increase in 2020, according to the Federal Housing Finance Agency’s (FHFA) Home Price Index. Historically, prices have grown at a pace of about 5% per year.

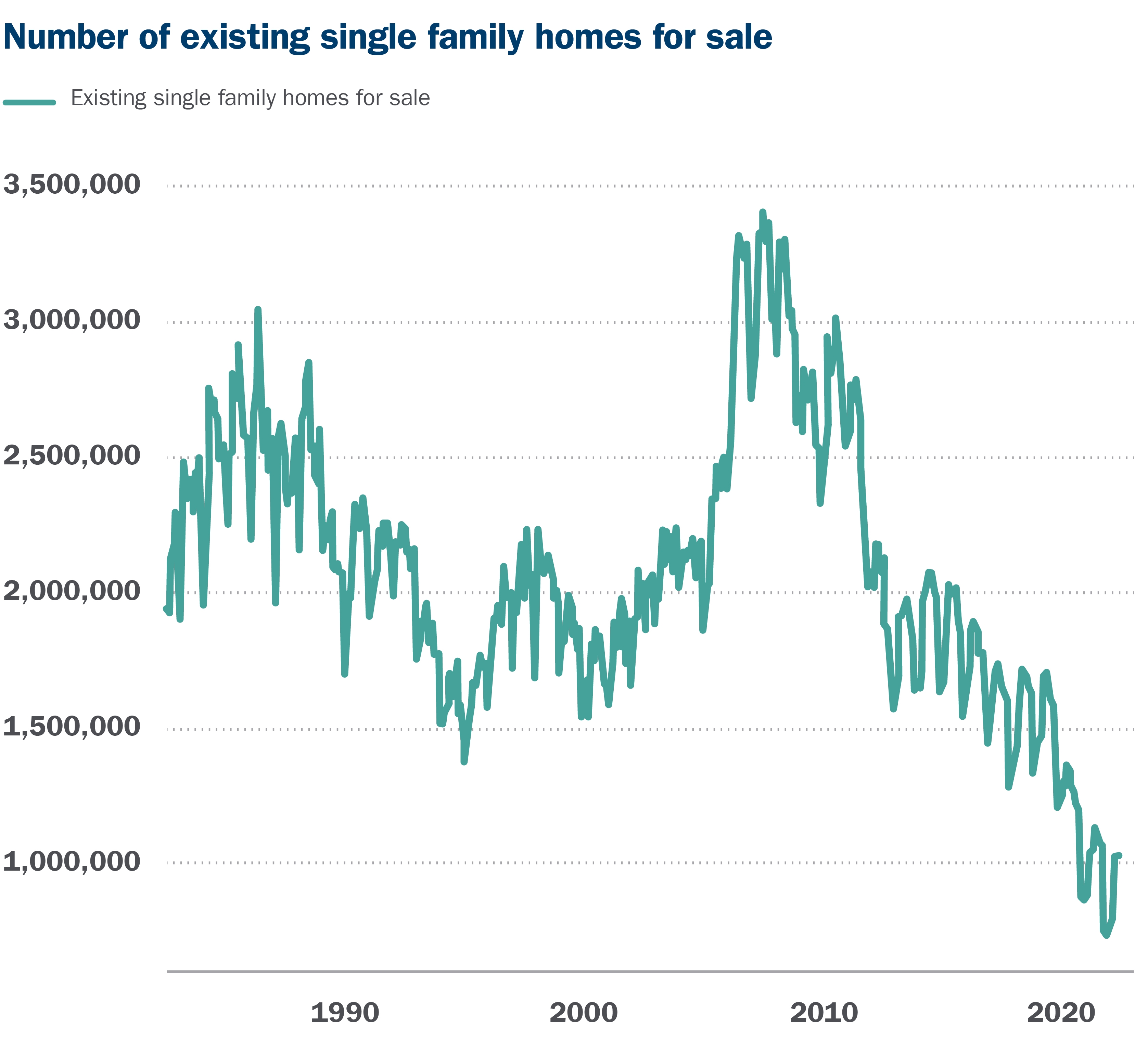

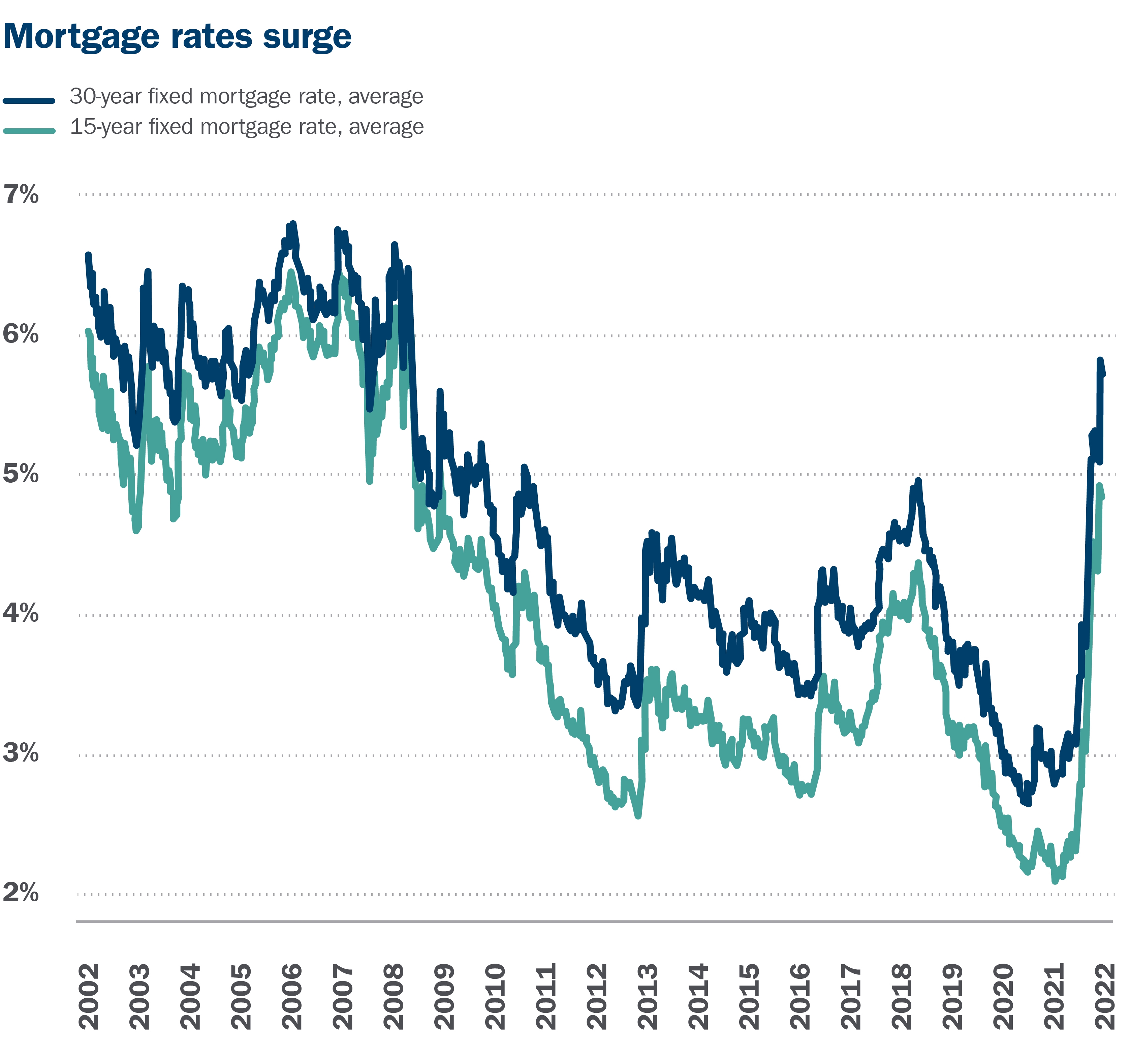

The housing market was already tight before the pandemic. But demand accelerated after the Federal Reserve drove down mortgage borrowing costs to record lows to support economic activity. This made the monthly payment on a home, even a more expensive home, more manageable. At the same time, the number of homes available for sale in the U.S. declined as many people were unwilling or unable to move due to COVID-19 conditions.

2. What will happen to home prices in 2022 and 2023?

New and existing home sales have slowed in recent months amid the jump in mortgage rates. The national average 30-year fixed rate mortgage started the year at 3.1% and ended the month of June at 5.7%. In June, existing home sales declined for the fifth straight month and at their slowest pace in two years. The median sales price, however, rose to a new record high of $416,000 in June, while mortgage applications over the last week dropped to lows last seen in 2000, according to the National Association of Realtors.

Though demand has slowed, the number of homes available for sale has remained close to historical lows. As such, home prices are still likely to grow, but at a much slower pace. The home-listing website Zillow projects median national average home prices to rise by 9.7% over the next year (from May 2022 through May 2023). For 2023, the Mortgage Bankers Association (MBA) and Fannie Mae predict existing home price growth of 3.1% and 3.2%, respectively.

So, potential buyers may have less competition for properties, but property values are still likely to move higher on average.

3. Are we in a housing bubble? Will there be a housing market crash similar to 2007–08?

No, we do not see current market conditions as being in a “bubble,” and we certainly do not see a correction similar to the crash of 2007–08 as likely.

During the period leading up to that crash, too many mortgages had been granted to individuals who did not have the financial position to manage the mortgage payments. Many home loans were also made with no money down, so new owners had no equity in the property. When home prices eventually declined, this made it easy for the mortgage holder to simply walk away from the property, thus fueling the crash. Today, mortgage holders have much stronger credit profiles and equity in the property. The majority of home loans made over the last two years have gone to those with high credit scores (760+) rather than the low scores of the Housing Bubble period, according to the New York Federal Reserve.

Additionally, the housing market in 2007 offered a surplus of homes for sale. Too many homes had been built in the preceding years. By contrast, in the decade prior to the COVID-19 pandemic, new home construction did not keep up with the demands of a rising population, in our view.

4. Is the U.S. housing market currently overvalued?

To say the housing market is over- or under-valued is subjective and may differ materially from one local market to the next. The home you want may not come down in price anytime soon, if ever. Regardless of conditions, it’s best not to overstretch your budget to buy a house you can’t afford.

New home prices, however, have been seeing some relief. And potential buyers for newly built properties may see more attractive pricing in the months ahead. Although mortgage borrowing costs are up, building costs for such key inputs as lumber and copper have declined significantly in recent months while prices for such items as carpeting and appliances have eased as well. The overall pace of new building activity has also stabilized somewhat, which could help ease labor costs in the segment.

5. With the recent increase in home prices, will housing affordability become an issue for the U.S. economy?

Today’s high property prices and rising mortgage rates make housing increasingly unaffordable for a growing share of the population.

Unfortunately, housing affordability has been a problem in the economy for several years. Since the years immediately following the Great Recession (2007–09), the economy has suffered from a lack of affordablehousing — that is, homes priced in a range that first-time buyers or families with modest incomes can afford. Given the tight supply of homes, builders have been incentivized to build larger homes where their profit margins are larger. As availability in these higher-priced segments grows, however, we have seen some evidence of builders slowly moving down the price-point scale.

How does your home factor into your financial situation?

For many Americans, the home is one of their most valuable financial assets. Talk with your Ameriprise financial advisor about how your home figures into your broader financial portfolio and goals.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link