The Florida Chamber Foundation presented its virtual 2025 Florida Economic Outlook & Jobs Solution Summit Jan. 30, with forecasts for the coming year ranging from population growth to tourism trends.

Highlights include:

Residential real estate: In 2025 in Florida, analysts expect to see a “little bit more inventory” with “more demand than there is housing,” according to Jennifer Warner, economist and director of development for Florida Realtors. There were about 170,000 active listings in 2024, which is a lot compared with 2023 but in line with historical averages, according to Warner. “We’re moving toward balance now,” she says. Demand coupled with a lack of affordability is likely to tip people into Florida’s rental market. “You’re going to see a lot of fewer first-time buyers,” Warner says, noting the median age of first-time home buyers nationally is 38 due to high costs and interest rates. “We’re expecting a lot more repeat buyers — people who already own selling and then buying — because they’re able to use equity to offset those higher lending costs. And we expect to see a lot of older and wealthier people transacting.” Baby boomers, she notes, have been aging in place, resulting in their homes staying off the market while others struggle to find larger houses.

Multifamily: “We are expecting to see more than 55,000 apartment homes be delivered to the market” in 2025, says Amanda White, vice president of government relations and research for the Florida Apartment Association. That is a slight “cooling” from 2024, when more than 77,000 apartments were delivered. Still, “Demand is really strong in the state of Florida,” White says, due to population growth and challenges facing single-family home buyers. “As soon as these apartments are delivered to the market, they’re being absorbed very quickly.” Rising costs, elevated borrowing rates and limited access to capital have caused a slowdown in new construction starts, she says. About 78% of developers surveyed said they experienced delays with permitting, and 81% of those say their deals were repriced during the construction process. “Construction costs have exploded” faster than the rate of inflation, according to White, who says this “will be a problem” as Florida’s housing stock ages; she notes 30% of Florida apartments were built before the 1980s, so they will need refurbishment.

Workforce: One in 14 jobs in the country is created in Florida, according to Mark Wilson, president of the Florida Chamber of Commerce and Foundation, who says there are more openings than people to fill them. Consistently, workforce participation in Florida has been lower than other states due to demographic trends, which could become a concern if untapped workforces are not prioritized, analysts say. People ages 20 to 29 years old have been leaving Florida in greater numbers, notes Sheridan Morby, senior research economist for the Florida Chamber Foundation. Some untapped workforce opportunities, according to Morby, are people ages 16 to 24 neither in school nor employed; 1.8 million Floridians without a high school diploma or GED who “require a little bit of upskilling,” she says; and 15% of parents with young children who left the workforce in the past six months due to challenges accessing child care.

Employers: Top concerns among employers are workforce development/talent; lack of affordable housing; runaway litigation and insurance costs; and infrastructure. Hiring will likely slow in 2025, while Florida’s unemployment rate is expected to stay low, about 3.6 to 3.8%, analysts say. The chamber foundation projects the state’s annual job growth will be 1 to 1.25%.

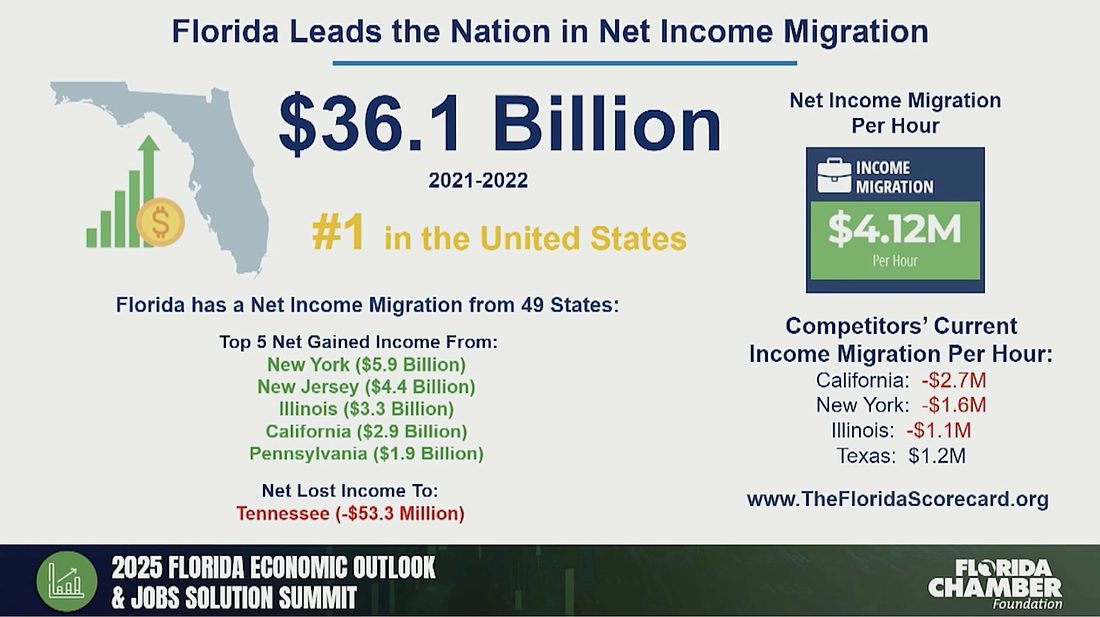

Population growth: Florida leads the nation in net income migration, with a gain of $36.1 billion from 2021 to 2022, with the most money coming from New York, New Jersey, Illinois, California and Pennsylvania. The only state Florida was losing money to was Tennessee. More people are moving to Florida than any other state; however, Florida also has the second highest outflow and was losing people to 19 states in 2023 versus 14 states in 2022. “When we look at a very important age bracket, 20 to 29, we do see an uptick in the amount of people who are leaving Florida,” Wilson says. “The top two reasons that they give us are the cost of homeownership and job opportunities in other states. That’s an interesting one, because remember, we have more open jobs in Florida than people looking for work. So we need to really double down … and make sure that we’re doing the right training for the right future jobs in Florida.” Florida Chamber Foundation analysts expect the state’s population to grow 1.7% in 2025 to about 23.75 million. In the next five years, more than 80% of Florida’s growth is expected to be in 10 counties: Miami-Dade, Orange, Hillsborough, Broward, Palm Beach, Duval, Lee, Polk, Osceola and Pasco.

Tourism: Florida had 140.6 million visitors in 2023, according to Brett Laiken, chief marketing officer for Visit Florida. Tourism added $127.7 billion to the economy and saved each Florida taxpayer $1,910 in 2023, Laiken says. Visitors spent $131 billion in 2023, a 4.9% increase, with about $14.9 billion coming from international visitors. Domestic visitors spent an average of $977 per trip to Florida, while international visitors stayed longer and spent more, totaling $1,436 per trip, Laiken says. About 2.1 million jobs statewide are supported by tourism.

Economic growth: Florida had the fourth highest gross domestic product (GDP) in the country, based on data from the second quarter of 2024. The state ranks behind California, Texas and New York. Florida’s GDP was $1.72 trillion, according to the Florida Chamber Foundation. The top industries for growth from the third quarter of 2020 to 2024 were transportation and warehousing (106.4%); arts, entertainment and recreation (103.2%); and accommodation and food services (97%). Florida Chamber Foundation analysts expect 2.5 to 3% annual real GDP growth in 2025.

Source: Elizabeth King Elizabeth is a business news reporter with the Business Observer, covering primarily Sarasota-Bradenton, in addition to other parts of the region. A graduate of Johns Hopkins University, she previously covered hyperlocal news in Maryland for Patch for 12 years. Now she lives in Sarasota County.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link