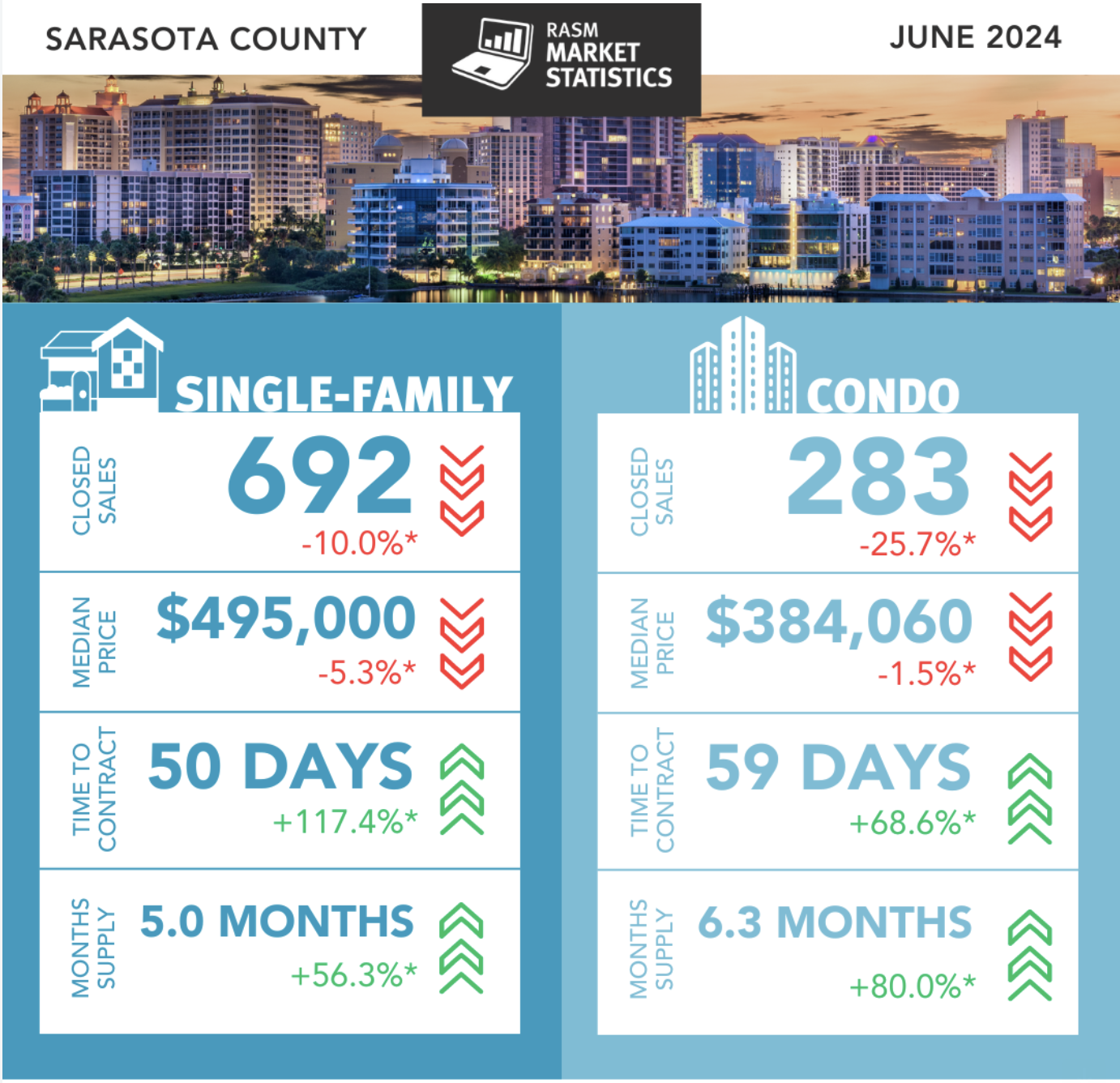

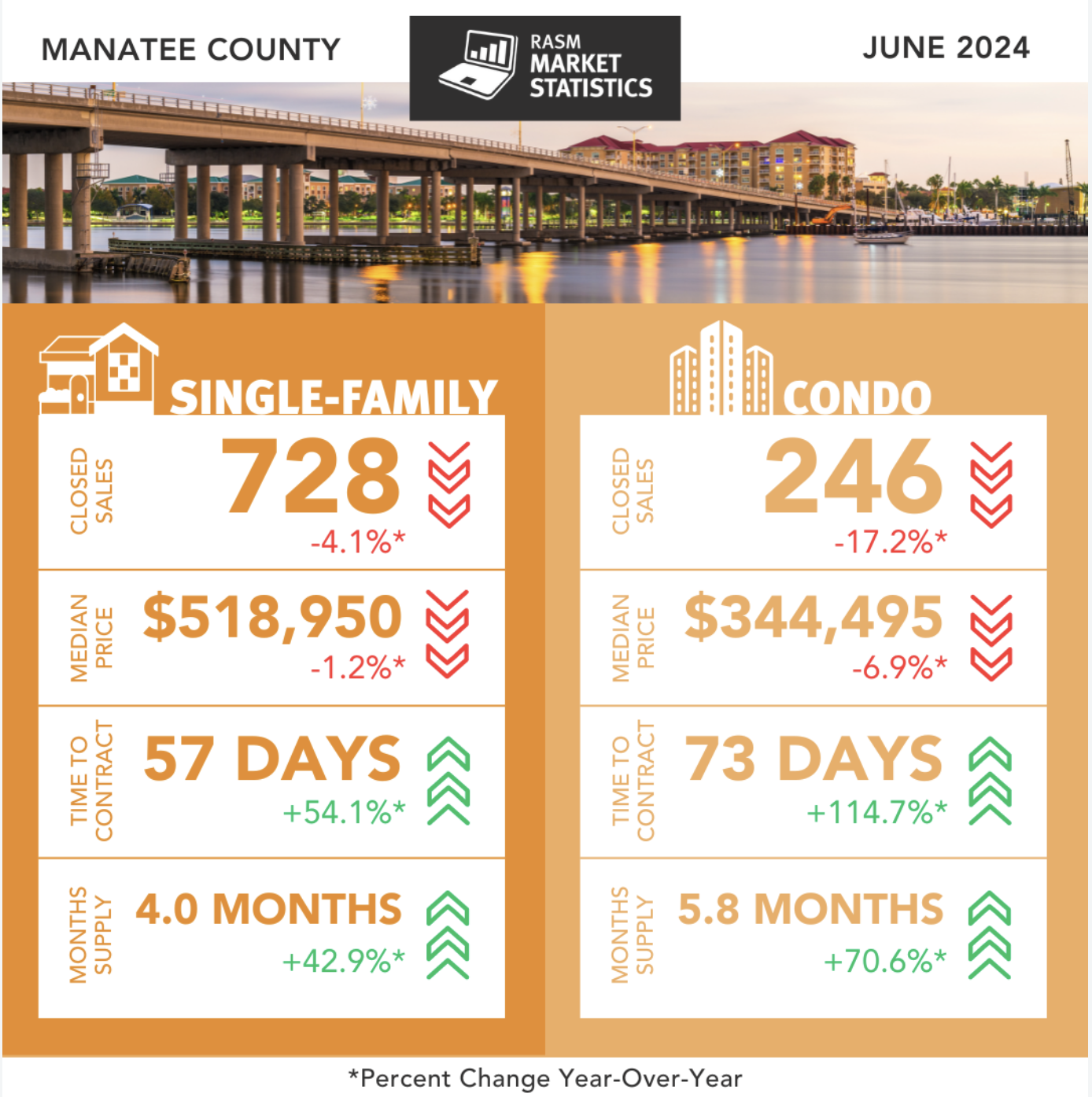

According to The REALTOR® Association of Sarasota and Manatee (RASM) the data highlights a trend towards a more balanced market across both counties, with increasing inventory levels and more moderate price changes. The shift in inventory suggests that buyers may find more opportunities, while sellers may need to adjust expectations in light of the growing competition.

According to The REALTOR® Association of Sarasota and Manatee (RASM) the data highlights a trend towards a more balanced market across both counties, with increasing inventory levels and more moderate price changes. The shift in inventory suggests that buyers may find more opportunities, while sellers may need to adjust expectations in light of the growing competition.

Even with more price reductions, home values are still growing on an annual basis, as they do nearly every year in the housing market. According to the Federal Housing Finance Agency (FHFA), home prices in Florida went up over 6% over the last year. For buyers, more realistic asking prices mean you enter the market with more confidence, knowing prices are stabilizing rather than continuing to skyrocket. For sellers, understanding the need to adjust your asking price can lead to faster sales and fewer price negotiations. Setting a realistic price from the start can attract more serious buyers and lead to smoother transactions.

Another positive sign for all home owners is AM Best, the largest credit rating agency in the world specializing in the insurance industry, announced it is “cautiously optimistic” about the Florida insurance market. The Florida Office of Insurance Regulation reports that at least eight carriers had filed for rate decreases in 2024, while 10 had filed to keep rates flat. It was not clear how many of the more than 7.4 million residential policies in the state would be affected by the decreases, but clearly things are going in the right direction.

The townhouses and condos market in Manatee County also experienced a decline in demand, with closed sales dropping by 17.2 percent to 246. The median sale price decreased by 6.9 percent to $344,495.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link