Housing inventory in both Sarasota County and Manatee County is on the rise, marking the highest number of listings reported this year in October. The latest data, sourced from Florida REALTORS® and compiled by the REALTOR® Association of Sarasota and Manatee (RASM), indicates an uptick in home sales and an influx of new listings added to the market.

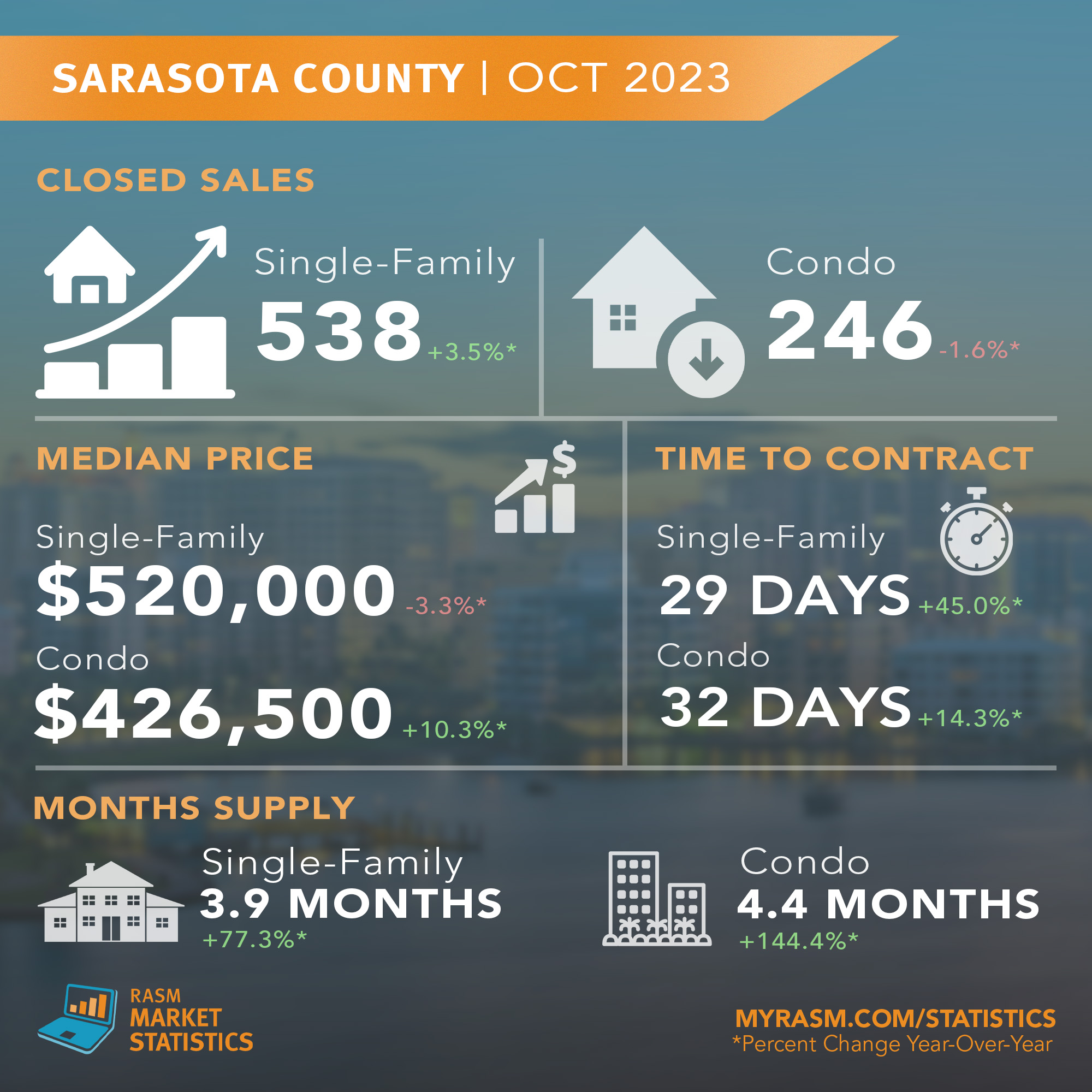

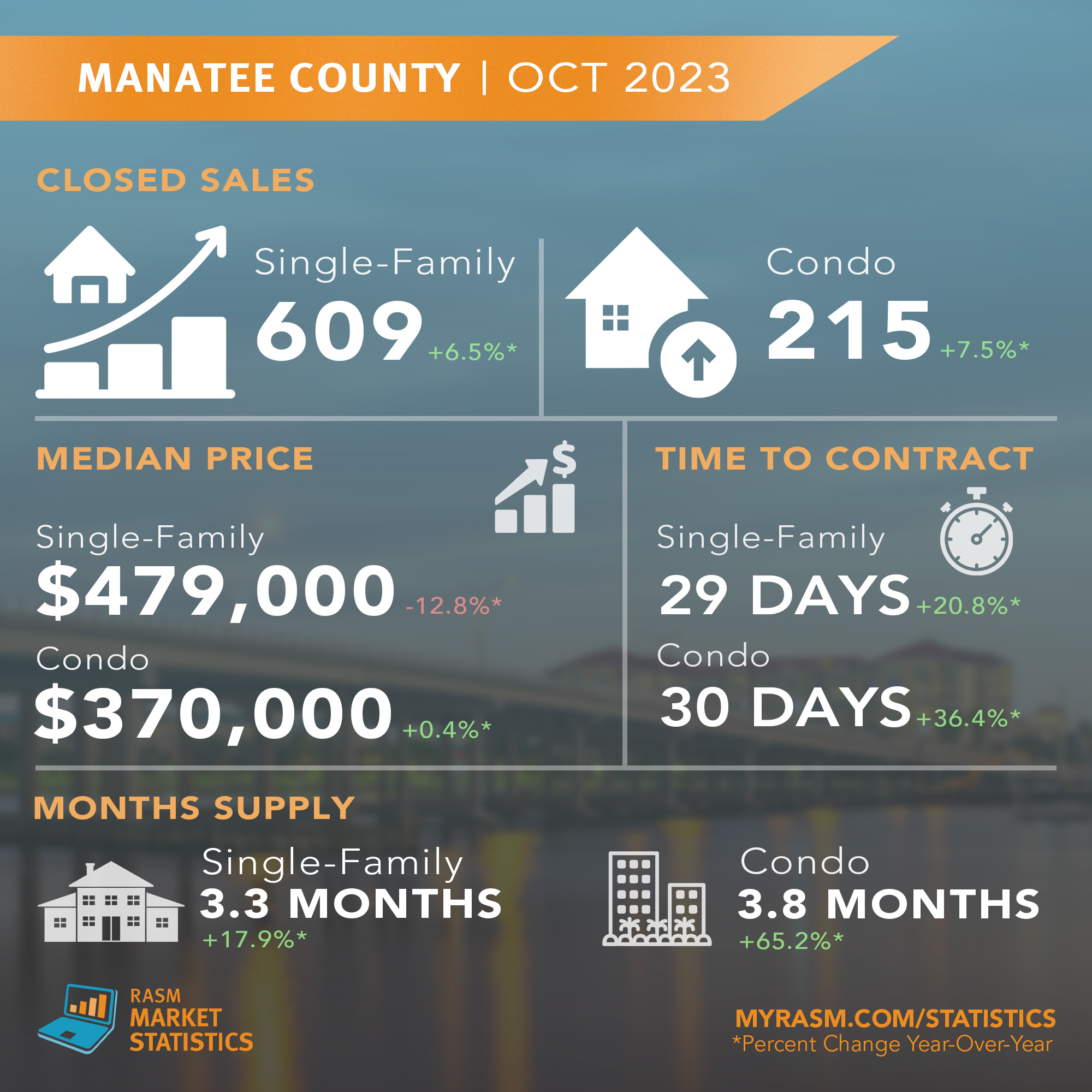

Combined sales for both property types in the North Port-Sarasota-Bradenton MSA increased year-over-year by 4.3 percent to 1,608 sales in October. In Manatee County, single-family home sales increased by 6.5 percent to 609 sales and condo sales increased by 7.5 percent to 215 sales. In Sarasota County, single-family home sales increased by 3.5 percent to 538 sales, while condo sales decreased by 1.6 percent to 246 sales. When compared to the previous month, there were 9.2 percent fewer home sales in October than in September of 2023.

“Compared to the rest of the country where home sales are declining in most markets, our housing market is telling a different story,” Brian Tresidder, 2023 RASM President and Vice President of Operations at William Raveis Real Estate. “This month’s data showcases an increase in sales, a rise in new listings, a leveling of the time from listing to contract, and strong inventory growth – all signs that point toward a more balanced market in our future.”

In October, median sale prices increased year-over-year for condos but decreased for single-family homes. The median price for Sarasota condos increased by 10.3 percent from last year to the highest recorded price in 2023 at $426,500, while the condo price in Manatee County increased by only 0.4 percent from last year to $370,000.

Median sale prices for single-family homes experienced the largest year-over-year percentage decrease for both counties so far this year. In Manatee County, the median sale price for single-family homes decreased by 12.8 percent, settling at $479,000, while Sarasota County saw a 3.3 percent decrease, bringing the price to $520,000 in October.

The month’s supply of inventory reached a new high for 2023, surpassing any other month thus far, and in some markets, it hasn’t been this high since 2020. For single-family homes, the month’s supply of inventory in Sarasota increased year-over-year by 77.3 percent to a 3.9-month supply and increased by 17.9 percent to a 3.3-month supply in Manatee County. Sarasota condos increased by 144.4 percent to a 4.4-month supply, and Manatee condos increased by 65.2 percent to a 3.8-month supply.

“Inventory has been on this steady increase since 2022, and while we’ve hit the highest it’s been all year, it’s still not quite back to pre-pandemic levels,” added Tresidder. “The good news is that we’ve been trending upward and we’re getting closer to the benchmark for a balanced market, which is a 5.5-month supply.”

The inventory of active listings is at its highest for the year with 6,710 active listings in the MSA at the end of October, a 46.9 percent increase from the same time last year and a 14 percent increase from the month prior. Across the two-county region, single-family home inventory increased by 32.8 percent to 4,418 active listings, and condo inventory increased by 84.7 percent to 2,292 listings.

New listings continue to rise this month, showing the highest year-over-year percentage growth for 2023 in October. At the end of the month, there were 2,614 new listings combined for both single-family homes and condos in the MSA, an 18.1 percent increase when compared to the previous month and a 46.3 percent increase when compared to the previous year. Broken down for each property type, there were 1,763 new listings for single-family homes and 851 new listings for condos in Sarasota and Manatee.

Another sign of the market’s return to pre-pandemic activity is the median time from listing date to contract date, with the shrinking year-over-year percentage gains each month. Single-family homes in Sarasota and Manatee counties went under contract within a median of 29 days, a year-over-year increase of 45 percent in Sarasota and 20.8 percent in Manatee. For condos, the median time to contract was 32 days for Sarasota and 30 days for Manatee, an increase of 14.3 percent and 36.4 percent respectively.

Monthly reports are provided by Florida Realtors® with data compiled from Stellar MLS. For comprehensive statistics dating back to 2015, visit www.MyRASM.com/

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link