|

|

|

|

|

|

|

|

|

|

According to The REALTOR® Association of Sarasota and Manatee (RASM) the data highlights a trend towards a more balanced market across both counties, with increasing inventory levels and more moderate price changes. The shift in inventory suggests that buyers may find more opportunities, while sellers may need to adjust expectations in light of the growing competition.

According to The REALTOR® Association of Sarasota and Manatee (RASM) the data highlights a trend towards a more balanced market across both counties, with increasing inventory levels and more moderate price changes. The shift in inventory suggests that buyers may find more opportunities, while sellers may need to adjust expectations in light of the growing competition.

Even with more price reductions, home values are still growing on an annual basis, as they do nearly every year in the housing market. According to the Federal Housing Finance Agency (FHFA), home prices in Florida went up over 6% over the last year. For buyers, more realistic asking prices mean you enter the market with more confidence, knowing prices are stabilizing rather than continuing to skyrocket. For sellers, understanding the need to adjust your asking price can lead to faster sales and fewer price negotiations. Setting a realistic price from the start can attract more serious buyers and lead to smoother transactions.

Another positive sign for all home owners is AM Best, the largest credit rating agency in the world specializing in the insurance industry, announced it is “cautiously optimistic” about the Florida insurance market. The Florida Office of Insurance Regulation reports that at least eight carriers had filed for rate decreases in 2024, while 10 had filed to keep rates flat. It was not clear how many of the more than 7.4 million residential policies in the state would be affected by the decreases, but clearly things are going in the right direction.

The townhouses and condos market in Manatee County also experienced a decline in demand, with closed sales dropping by 17.2 percent to 246. The median sale price decreased by 6.9 percent to $344,495.

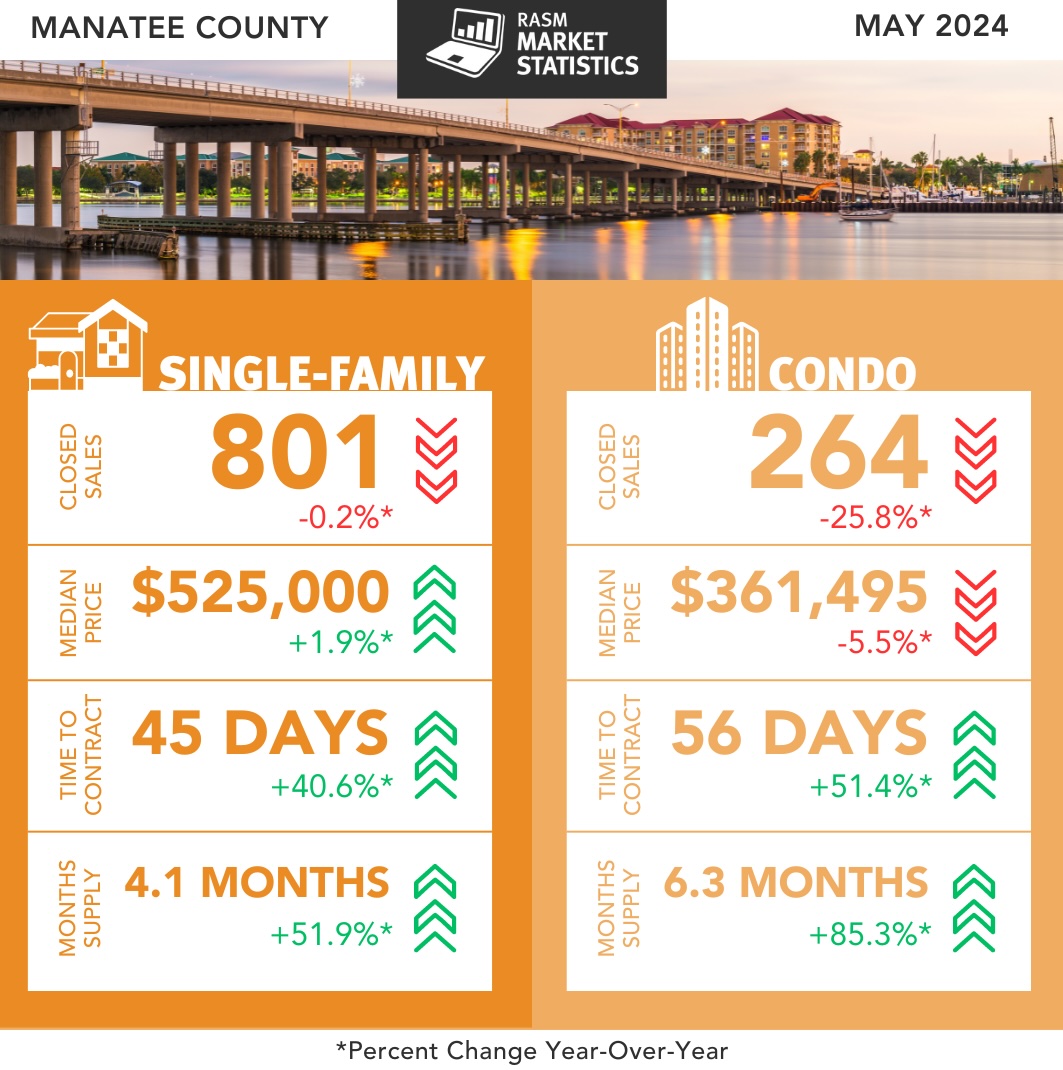

Key Trends in May 2024:

• Sarasota County: Single-family homes are seeing stable sales and rising prices with increasing inventory, suggesting a shift towards a buyer’s market. The condo/townhouse market is showing a decrease in sales, with decreasing prices and increasing inventory, indicating a potential buyer’s market as well.

• Manatee County: Both single-family homes and condos/townhouses are experiencing fewer sales and increasing inventory, indicating a potential shift towards a buyer’s market. Prices for single- family homes are stable, but condos/townhouses are seeing slight decreases.

Complete Report: https://www.myrasm.com/clientuploads/Market_Statistics_PDFs/2024/May/May-2024-Press-Release-and-Statistics.pdf

Many real estate contracts allow buyers to “assign” their rights and obligations under the contract, and sellers can suddenly find themselves working with Joe rather than Sally. What’s a Realtor to do? Ask the right questions – and don’t give legal advice.

ORLANDO, Fla. – Florida Realtors® Legal Hotline fields many calls from members, and some topics come in waves. Currently, one of those waves is made up of Realtors® perplexed by contract paragraphs about assignability. Most callers want to know how it should be completed and whether it applies to their current transaction.

Since Realtors rather than actual buyers or sellers complete form contracts, it’s important to understand the legal concept of assignment, as well as the agent’s role when a customer has an assignable contract.

In the Florida Realtors/Florida Bar contracts (FR/Bar), assignability of contract is addressed in paragraph 7. For the purposes of this article, the examples are based on the FR/Bar residential contracts – but always refer to the contract used in your transaction since it varies.

In applying these concepts to language in the FR/Bar contract, a buyer’s agent should ask the buyer if they have any intention of assigning their interests in the contract to another party. If yes, does the buyer want to remain potentially liable under the contract should the assignee fail to perform?

If a seller’s agent receives an offer that is assignable, they should ask the seller if they’re willing to allow the buyer to assign the contract to a third party. If yes, is the seller okay with allowing the initial buyer to just walk away, or do they want to hold the initial buyer to the contract terms as far as liability is concerned?

Please note: These are all questions your customers should answer. A Realtor shouldn’t give legal advice, explain the concept of assignability, or describe potential outcomes or issues that could arise with an assignable contract. If your questions cause customers to ask even more questions about assignability, you should advise customers to seek legal advice from their attorney.

Lastly, understand that this article covers the contract portion of assignability. Assuming the parties agree the contract is assignable, a buyer who later wants to assign the contract still needs to sign a separate legal document assigning their rights/interests in the contract over to the assignee, aka “the new buyer.”

The initial buyer/assignor may need their attorney to assist with drafting this document, which covers their agreement. In other words, paragraph 7 only covers whether the seller and initial buyer agree to the initial buyer being able to assign the contract. A separate assignment document would cover the assignor and assignee’s agreement.

Meredith Caruso is Associate General Counsel for Florida Realtors

© 2024 Florida Realtors

.

.

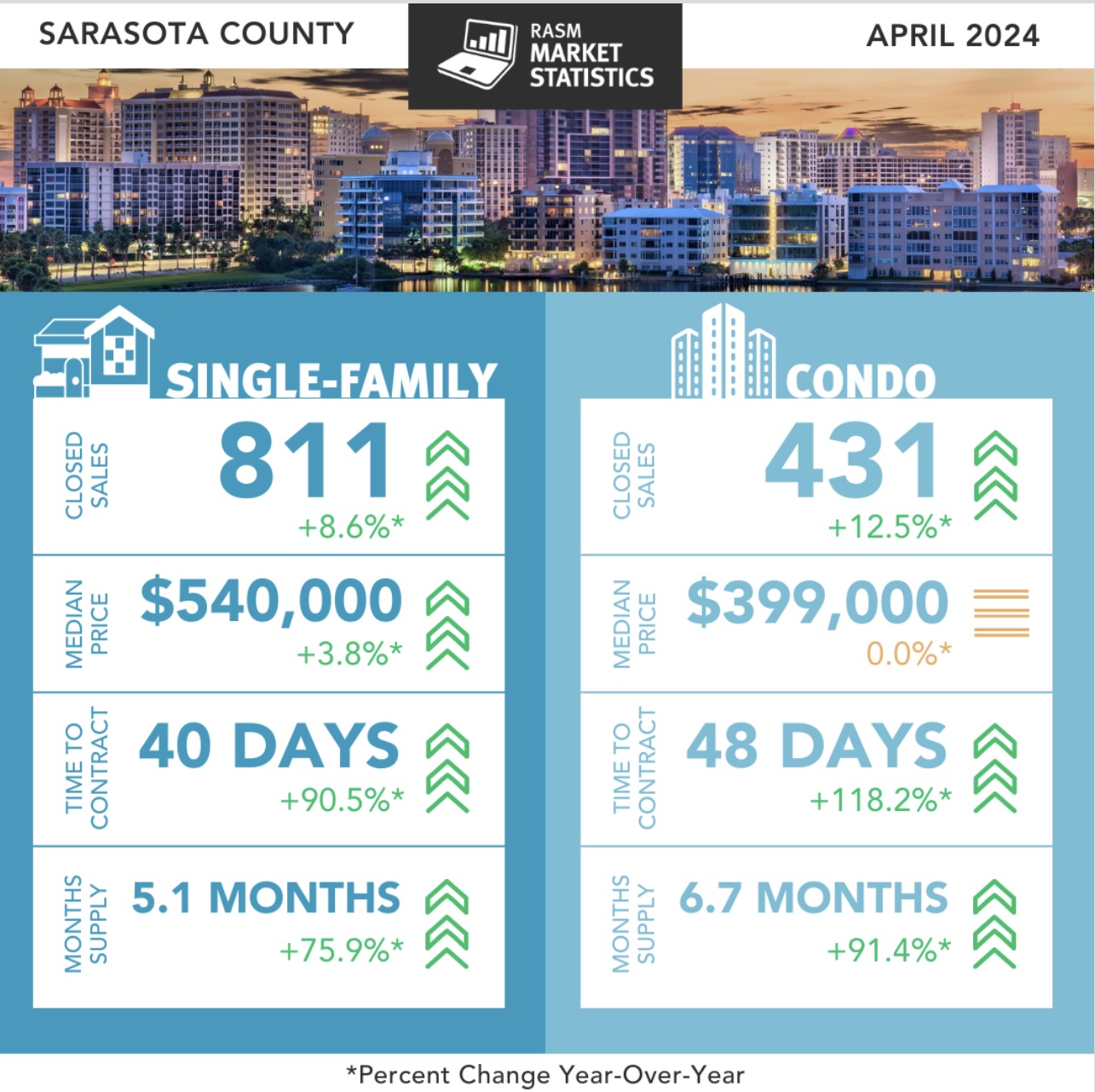

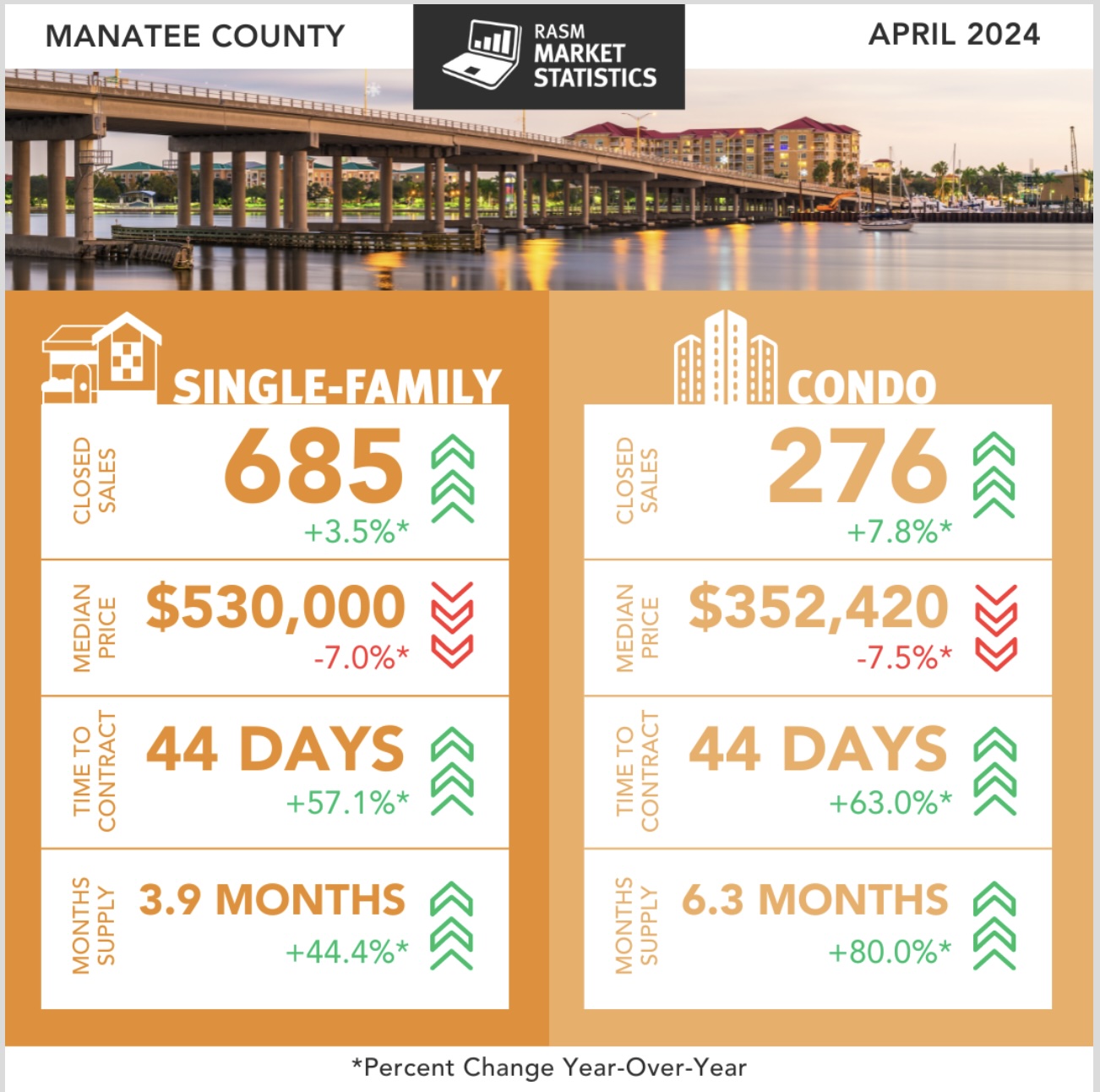

The REALTOR® Association of Sarasota and Manatee (RASM) today released its monthly market report detailing the real estate trends for April 2024. The data reveals a significant shift in the market dynamics of both counties, marked by rising inventory levels, extended time on the market, and varying price trends.

Inventory continues to be a topic of discussion in April 2024. In Sarasota County, inventory increased year-over-year by 81.2 percent to 3,305 for single-family homes and 91 percent to 2,124 for condos. In Manatee County, inventory increased by 60 percent to 2,450 for single-family homes and 92.4 percent to 1,512 for condos.

“The significant rise in inventory across both counties is a clear indication of a shifting market dynamic. Buyers now have more options to choose from, which is reflected in the extended time properties are staying on the market,” said Tony Barrett, 2024 RASM President and Broker/Owner of Barrett Realty.

In April, the months’ supply of inventory (MSI) for single-family homes decreased from one month ago from 5.3 months to 5.1 months in Sarasota County and from 4.1 months to 3.9 months in Manatee County. For townhomes and condos, the MSI decreased from 6.8 months to 6.7 months in Sarasota County and from 6.4 months to 6.3 months in Manatee County.

There was a total of 1,496 closed sales for single-family homes in Sarasota and Manatee, a 6.2 percent increase from the same time last year. Closed sales for condos increased by 10.6 percent to 707 sales across both counties.

“It’s encouraging to see closed sales increase, even with the higher inventory levels. This indicates that buyers are still actively engaging with the market, taking advantage of the increased options available to them,” added Barrett.

The median time to contract in Sarasota County is 40 days for single-family homes and 48 days for condos, a year-over-year increase of 90.5 percent and 118.2 percent respectively. In Manatee County, the median time to contract increased by 57.1 percent to 44 days for single-family homes and by 63 percent to 44 days for townhomes and condos.

The median sales price for single-family homes in Sarasota County increased year-over-year by 3.8 percent to $540,000 and remained steady at $399,000 for townhomes and condos. In Manatee County, condo prices decreased by 7.5 percent to $352,420, and single-family home prices decreased by 7 percent to $530,000.

Monthly reports are provided by Florida Realtors® with data compiled from Stellar MLS. For comprehensive statistics dating back to 2015, visit www.MyRASM.com/statistics.

The 2024 Real Estate Market in Sarasota and Manatee Counties: Trends

and Predictions.

See FULL REPORT HERE

SARASOTA, Fla. (April 18, 2024) – The real estate markets in Sarasota and Manatee counties have undergone significant changes throughout the first quarter of 2024, reflecting broader economic influences and evolving buyer and seller behaviors. This press release provides an overview of these

changes, based on the latest data released by Florida Realtors®, and offers insights into the implications for the remainder of the year.

Key Trends in Q1:

• Increased Inventory Levels: Inventory grew 64.6 percent for single-family homes and 90.9

percent for townhomes and condos across both Sarasota and Manatee Counties since Q1 2023,

significantly shifting market dynamics.

• Extended Time on Market: Median time to contract for single-family homes and condos

increased to an average of 43 days in Sarasota County and 51 days in Manatee County in Q1 of

2024, indicating that properties are taking longer to reach the closing phase.

• Price Adjustments: Median sales price decreased year-over-year in March 2024. Single-family

homes decreased 0.6 percent and townhouses and condos decreased 6.1 percent combined across

Sarasota and Manatee counties.

• High Cash Sales: In Q1, cash sales increased by a total of 5.9 percent across Sarasota and

Manatee counties for single-family homes and condo transactions. This trend highlights a

significant portion of buyers and investors, who prefer or can bypass traditional financing routes.

The data suggests that both Sarasota and Manatee counties are transitioning towards market conditions that favor buyers, with more negotiating power due to increased supply. However, the high rate of cash sales continues to impact the dynamics, potentially sidelining first-time homebuyers and those reliant on financing.

“The real estate market in 2024 has been one of adjustment and realignment. Buyers and sellers in Sarasota and Manatee counties should stay informed on these trends, as they indicate a more competitive market heading into 2025,” said Tony Barrett, 2024 RASM President and Broker/Owner of Barrett Realty. “Particularly, buyers have more options and leverage, while sellers might need to adjust expectations regarding pricing and time on market.”

March 2024 Statistics

Inventory/listings, has more than doubled in both counties when compared to March of 2023. In Sarasota County, inventory increased year-over-year by 76.6 percent to 3,374 for

single family homes and 100.3 percent to 2,153 for condos. In Manatee County, inventory increased by 51.3 percent to 2,581 for single family homes and 78.9 percent to 1,519 for condos.

In March, the months supply of inventory (MSI) for single-family homes increased to 5.3 months in Sarasota County and 4.1 months in Manatee County. For townhomes and condos, the MSI increased to 6.8 months in Sarasota County and to 6.4 months in Manatee County. Florida Realtors® states that the benchmark for a balanced market (favoring neither buyer nor seller) is 5.5 months of inventory.

The median time to contract in Sarasota County is at 40 days for single-family homes and 51 days for condos, a year-over-year increase of 60 percent and 183.3 percent respectively. In Manatee County, median time to contract increased by 10.9 percent to 51 days for single-family homes and by 134.8 percent to 54 days for townhomes and condos.

The median sales price for single-family homes in Sarasota County decreased year-over-year by 2.5

percent to $515,000 and decreased by 8.9 percent to $385,775 for townhomes and condos. Manatee

County condo prices decreased by 2.8 percent to $342,988, while single-family home prices increased by 1.4 percent to $498,805.

In March 2024, cash sales remained high.

Sarasota County reported 44.5 percent of single-family home sales and 70.3 percent of townhome and condo sales were paid for in cash.

Manatee County had 33.4 percent of single-family homes and 51.8 percent of townhome and condo sales paid for in cash.

There were 1,453 closed sales for single-family homes in Sarasota and Manatee, an 8.2 percent decrease from the same time last year. Closed sales for condos decreased by less than one percent to 686 sales.

As the market begins to shift to more competitive levels, these current trends provide opportunities for buyers but require sellers to be more strategic in their approach.

——————————————————————————————————–

Monthly reports are provided by Florida Realtors® with data compiled from Stellar MLS. For

comprehensive statistics dating back to 2015, visit www.MyRASM.com/statistics. The REALTOR® Association of Sarasota and Manatee (RASM) is the largest real estate trade association in Sarasota and Manatee counties, serving over 9,000 members. For more information, call (941) 952-3400 or visit www.myrasm.com.

FREC adopted a rule to implement a portion of Senate Bill 264 entitled Interests of Foreign Countries.

ORLANDO, Fla. – A rule containing buyer affidavits went into effect today, Jan. 17, 2024. It was created by the Florida Real Estate Commission (FREC) with the help of industry partners. It relates to SB 264, which, in part, regulates the sale, purchase and ownership of certain Florida properties to foreign principals, persons and entities, and went into effect on July 1, 2023.

Buyers are to sign the applicable affidavit (one form is for buyers who are natural persons, and one form is for buyers that are entities) “at the time of purchase,” which the rule specifies is at closing. There is no responsibility for a real estate licensee to provide the affidavit to the buyer. Instead, real estate licensees should advise the parties in the transaction to seek the advice of counsel when they are seeking answers to their legal questions as they relate to this law.

SB 264, the rule and requirements, along with the affidavit, can be found on the Florida Administrative Code and Register website.

© 2024 Florida Realtors®

Experience the enchantment of the 45th Annual Holiday Night of Lights, transforming St. Armands Circle into a Gulf Coast holiday haven. Immerse yourself in the festive kick-off at 5:30 p.m., followed by a joyous Christmas Carol Sing-a-long at 6 pm. Help Santa count down the final 10 seconds to illuminate the Circle with our 60-foot Christmas tree!

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

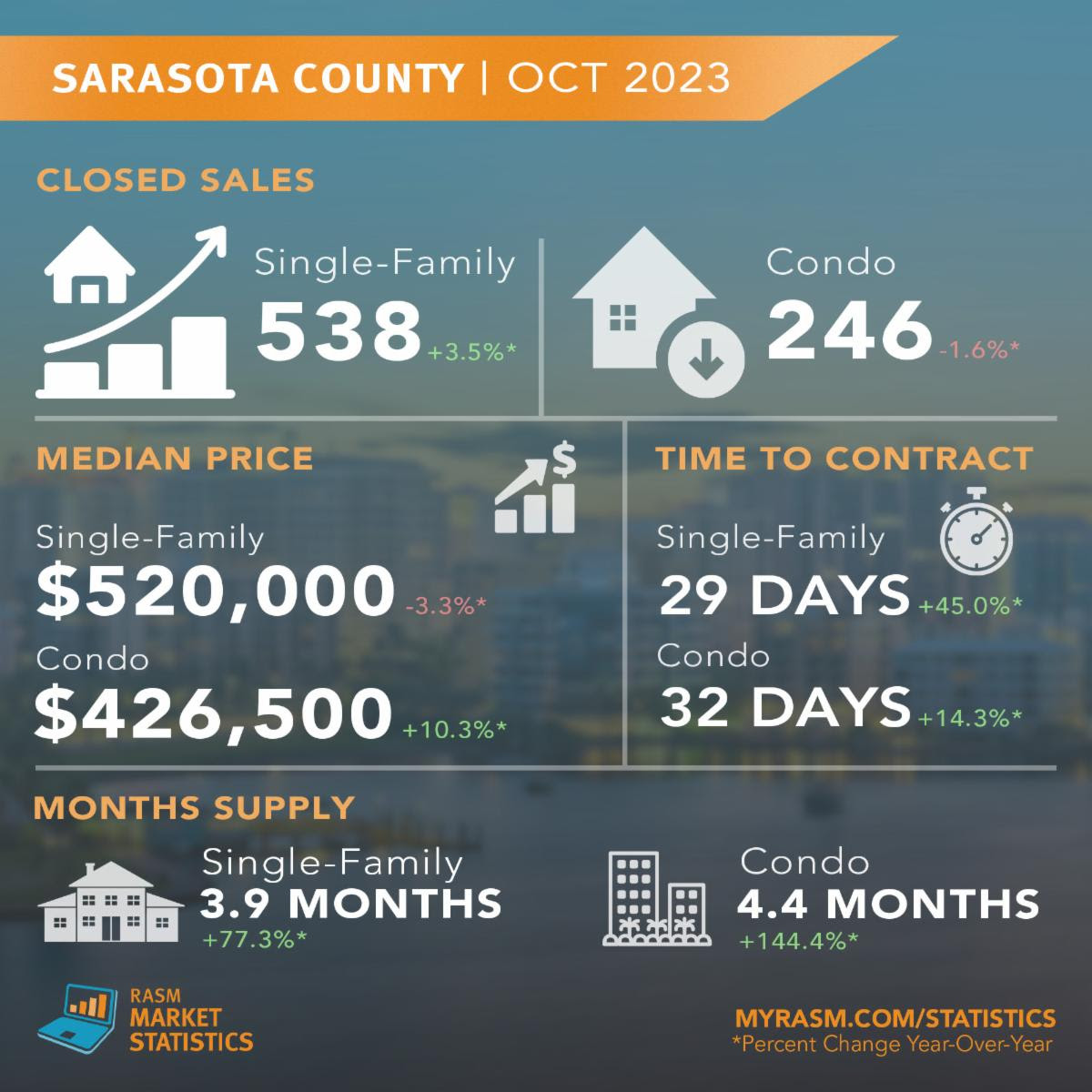

Housing inventory in both Sarasota County and Manatee County is on the rise, marking the highest number of listings reported this year in October. The latest data, sourced from Florida REALTORS® and compiled by the REALTOR® Association of Sarasota and Manatee (RASM), indicates an uptick in home sales and an influx of new listings added to the market.

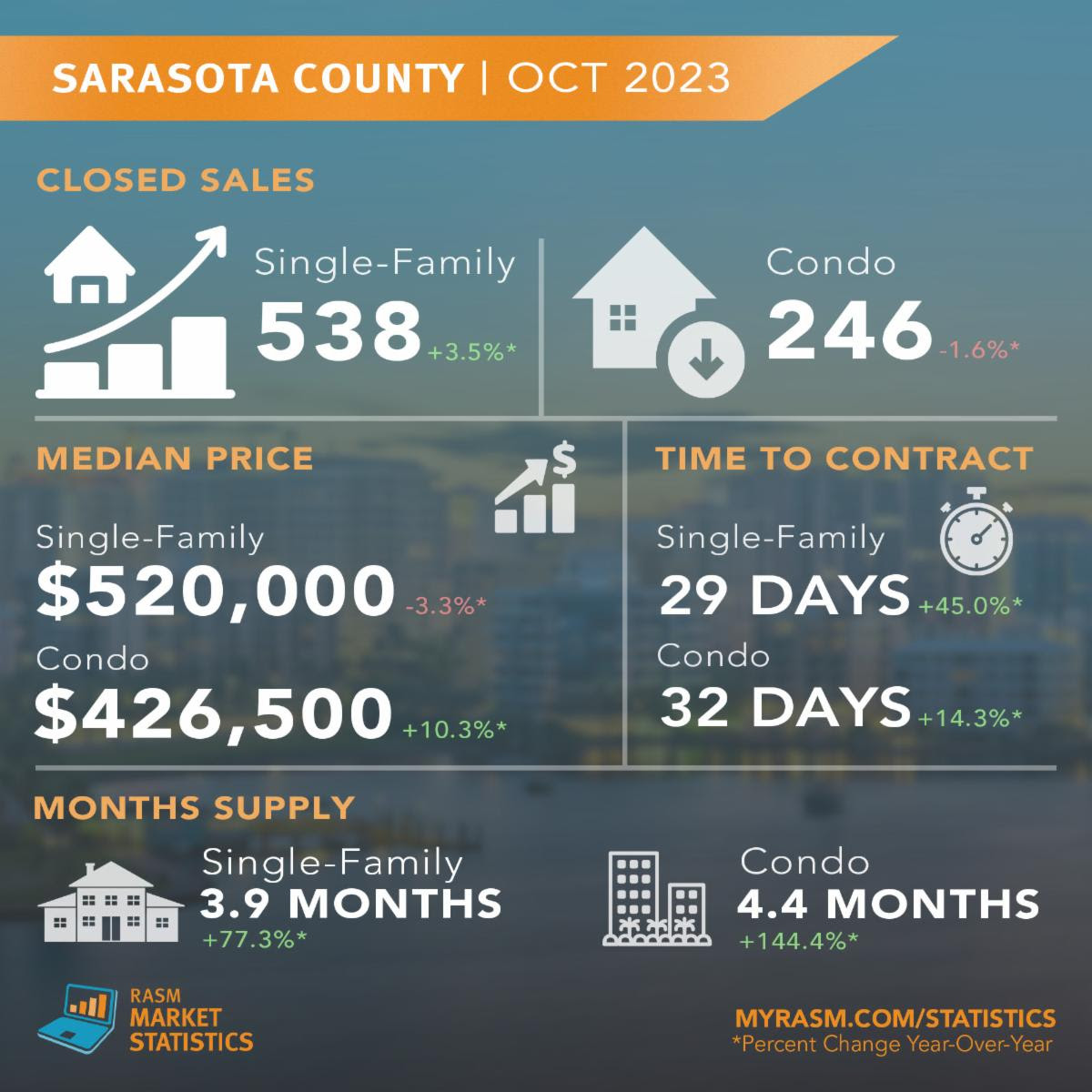

Combined sales for both property types in the North Port-Sarasota-Bradenton MSA increased year-over-year by 4.3 percent to 1,608 sales in October. In Manatee County, single-family home sales increased by 6.5 percent to 609 sales and condo sales increased by 7.5 percent to 215 sales. In Sarasota County, single-family home sales increased by 3.5 percent to 538 sales, while condo sales decreased by 1.6 percent to 246 sales. When compared to the previous month, there were 9.2 percent fewer home sales in October than in September of 2023.

“Compared to the rest of the country where home sales are declining in most markets, our housing market is telling a different story,” Brian Tresidder, 2023 RASM President and Vice President of Operations at William Raveis Real Estate. “This month’s data showcases an increase in sales, a rise in new listings, a leveling of the time from listing to contract, and strong inventory growth – all signs that point toward a more balanced market in our future.”

In October, median sale prices increased year-over-year for condos but decreased for single-family homes. The median price for Sarasota condos increased by 10.3 percent from last year to the highest recorded price in 2023 at $426,500, while the condo price in Manatee County increased by only 0.4 percent from last year to $370,000.

Median sale prices for single-family homes experienced the largest year-over-year percentage decrease for both counties so far this year. In Manatee County, the median sale price for single-family homes decreased by 12.8 percent, settling at $479,000, while Sarasota County saw a 3.3 percent decrease, bringing the price to $520,000 in October.

The month’s supply of inventory reached a new high for 2023, surpassing any other month thus far, and in some markets, it hasn’t been this high since 2020. For single-family homes, the month’s supply of inventory in Sarasota increased year-over-year by 77.3 percent to a 3.9-month supply and increased by 17.9 percent to a 3.3-month supply in Manatee County. Sarasota condos increased by 144.4 percent to a 4.4-month supply, and Manatee condos increased by 65.2 percent to a 3.8-month supply.

“Inventory has been on this steady increase since 2022, and while we’ve hit the highest it’s been all year, it’s still not quite back to pre-pandemic levels,” added Tresidder. “The good news is that we’ve been trending upward and we’re getting closer to the benchmark for a balanced market, which is a 5.5-month supply.”

The inventory of active listings is at its highest for the year with 6,710 active listings in the MSA at the end of October, a 46.9 percent increase from the same time last year and a 14 percent increase from the month prior. Across the two-county region, single-family home inventory increased by 32.8 percent to 4,418 active listings, and condo inventory increased by 84.7 percent to 2,292 listings.

New listings continue to rise this month, showing the highest year-over-year percentage growth for 2023 in October. At the end of the month, there were 2,614 new listings combined for both single-family homes and condos in the MSA, an 18.1 percent increase when compared to the previous month and a 46.3 percent increase when compared to the previous year. Broken down for each property type, there were 1,763 new listings for single-family homes and 851 new listings for condos in Sarasota and Manatee.

Another sign of the market’s return to pre-pandemic activity is the median time from listing date to contract date, with the shrinking year-over-year percentage gains each month. Single-family homes in Sarasota and Manatee counties went under contract within a median of 29 days, a year-over-year increase of 45 percent in Sarasota and 20.8 percent in Manatee. For condos, the median time to contract was 32 days for Sarasota and 30 days for Manatee, an increase of 14.3 percent and 36.4 percent respectively.

Monthly reports are provided by Florida Realtors® with data compiled from Stellar MLS. For comprehensive statistics dating back to 2015, visit www.MyRASM.com/